View in browser |

|

Good morning. After declaring independence from Britain in 1776, America saw the ultimate reversal: the UK officially commandeered cultural staple Saturday Night Live. After celebrating the comedy show’s 50th anniversary, SNL creator Lorne Michaels will produce the British edition featuring “the funniest British comedians around.” Call it

reparations for when America stole The Office — it only took 20 years to return the favor. |

|

|

|

|

|

CHINA |

Trump’s 90-Day Pause Is Here, But Not for China — Here’s What That Means |

|

Although one tariff battle might be over, the trade war is still alive and kicking. On Wednesday, President Donald Trump unexpectedly announced a “90-day delay” on his so-called “reciprocal tariffs,” marking the end of a tumultuous last few days on Wall Street — where stocks booked performances that could only be likened to history market tumbles in 2020, 2008, and earlier. Unfortunately for many investors — and Americans — the chaos will likely return. Although investors initially rewarded the markets for Trump ‘calling off the dogs’ on countries that had not yet retaliated against the highest tariff rates in a generation, there still remains a $582B elephant in the room. China trouble: While Trump’s 90-day pause on tariffs means most countries will pay just a 10% tariff rate — in addition to a 25% duty on cars, steel, and aluminum — a heated situation is only getting warmer with China, America’s second-largest trade partner. The nation was quick to retaliate against Trump’s

reciprocal tariffs, imposing levies of its own in response to the President’s 54% tariff rate. In response, Trump more than doubled the tariff rate on China — spurring even greater ire from Beijing. As a result of the back and forth, the US now tariffs Chinese goods at 145% — while China tariffs US imports at 84%. That could

be a problem unto itself.

- Pundits anticipate that a trade war exclusively with China is enough to push the US into recession, threatening many small businesses and large enterprises alike.

- On the other hand, a trade war with the US could threaten to destabilize China, which counts the US as its largest trading partner — especially in a period where its housing market and broader economy are just starting to recover.

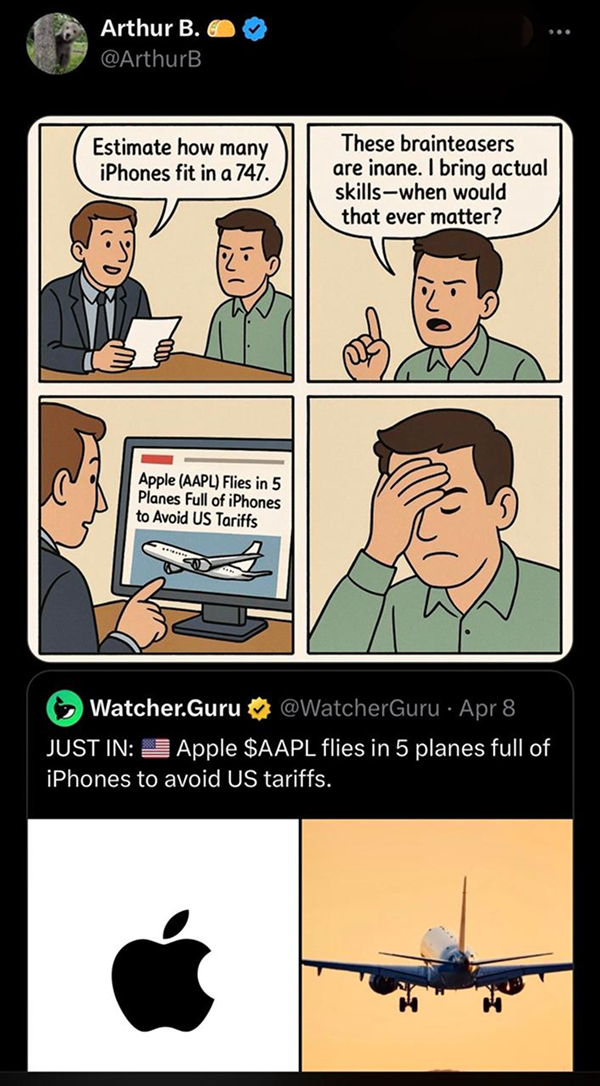

Fallout: New Trade WarA long and expensive trade war with China will likely take its toll on firms like Apple ($AAPL), which flew in more than 600 tons of iPhones ahead of the start of the tariffs. Further, companies with large volumes

of sales in the mainland are also at risk — names like Corning ($GLW), Albemarle ($ALB), and Intel ($INTC), among others. But the real risks

could come from China’s response, which could be nothing short of financial warfare.

- To meet the moment, China has been slowly devaluing its currency — and pundits speculate it could begin selling its significant stock of US treasuries and mortgage-backed securities to put pressure on the US market.

- In addition, China is reportedly considering the use of tactical cyberattacks against various US assets, including businesses — some of which might even be banned from China as part of its countermeasures.

But there could always be a deal: Trump says he wants to make deals with countries before his 90-day détente concludes — and he hasn’t precluded an extension of his pause. That dealmaking desire extends to China, where Trump says that he “think[s] it’s going to work out.” But an

alienated Beijing is willing to fight back. It’s already eying trade partnerships with the rest of the Asian continent in response to the tariffs, which former Commerce Department official Nazak Nikahtar warns could bring trade between the two countries to a halt. |

|

|

|

|

PARTNERED WITH BRAD'S DEALS |

9 Amazon Prime Perks You’re (Probably) Not Using — But Definitely Should Be |

|

Amazon Prime isn’t just for last-minute impulse buys and bingeing The Boys. You're probably paying $14.99/month… but are you actually getting your money’s worth? Turns out, Prime is stacked with perks most people forget even exist — from free music and podcasts to Whole Foods discounts and early access to lightning deals (because being first matters when you're hunting deals like it’s Black Friday). Whether you're already a member or just Prime-curious, Brad’s Deals team of expert bargain hunters put together a list of 9 underrated perks that’ll make you feel like a savvy shopping ninja. Click below to see what you’ve been missing. Get the list — it’s free |

|

|

|

|

|

LARGECAP RECAP |

🏦 Big Bank Earnings Land Today as Markets Hold Their Breath |

After watching the $KBWB bank index collapse almost 16% since Apr. 2’s tariff announcement, Wall Street titans now face a Promethean task: telling investors what comes next. JPMorgan ($JPM),

Wells Fargo ($WFC), Morgan Stanley ($MS), and others report earnings today — with all eyes on forward guidance as the passing quarter reflects pre-trade war conditions.

- “Banks [earnings] are a reflection of the economy,” noted an analyst, as JPMorgan’s CEO warned that tariffs “will drive up inflation and slow growth” — creating jitters around Wall Street’s response to Trump’s 90-day truce.

- Analysts are scrutinizing whether business loan growth stalls, indicating executives “are hitting the pause button” — but also changes in overall credit quality, loan write-offs, and increases to loss reserves.

Deals on ice: Even with the market comeback, a Barclays analyst says, “Investment banking fees are expected to fall” as Klarna, StubHub, and eToro shelve IPO plans. Amid the market volatility, Reuters notes trading desks can thrive despite wealth management units suffering

portfolio losses. However, regional banks stand the most exposed compared to their diversified megabank counterparts — already receiving analyst downgrades. As earnings season unfolds, Trump’s 90-day pause feels more like the eye of the hurricane. |

|

|

🚀 Leveraged ETF Thrill-Seekers Score Massive Gains After Market Rebound |

|

|

While most investors ran for the exits, a bold cohort tripled down on market chaos. As Trump’s “Liberation Day” pummeled markets, traders poured $3.4B into the ProShares UltraPro QQQ ETF ($TQQQ) from Thursday to Tuesday. Their gamble paid off spectacularly when Trump’s tariff rollback sparked the greatest Nasdaq surge since 2001 — catapulting the 3x leveraged fund by 35% on Wednesday.

- With tech’s Magnificent 7 stocks tumbling around 20% YTD, BlackRock’s ($BLK) thematic ETF head notes that “investors have been hunting for deals” — evidenced by $TQQQ’s record-breaking inflow.

- Beyond the leveraged Nasdaq 100 fund, the Direxion Daily Semiconductor Bull 3x Shares fund ($SOXL) soared 56% Wednesday — while traders also turned to leveraged Nvidia ($NVDA) and Tesla ($TSLA) products.

Double-edged sword: Despite the eye-watering returns, these leveraged funds plummeted the very next day, with $TQQQ crashing 12.3% and $SOXL nosediving 24.6% on Thursday’s retreat. While they amplify daily returns, their long-term performance often diverges significantly from underlying assets — a costly lesson for those paying premium expense ratios (0.84% and 0.75%, respectively). In the leveraged ETF game, investors discovered that fortune only favors the bold on Wednesdays. |

|

|

|

|

|

|

|

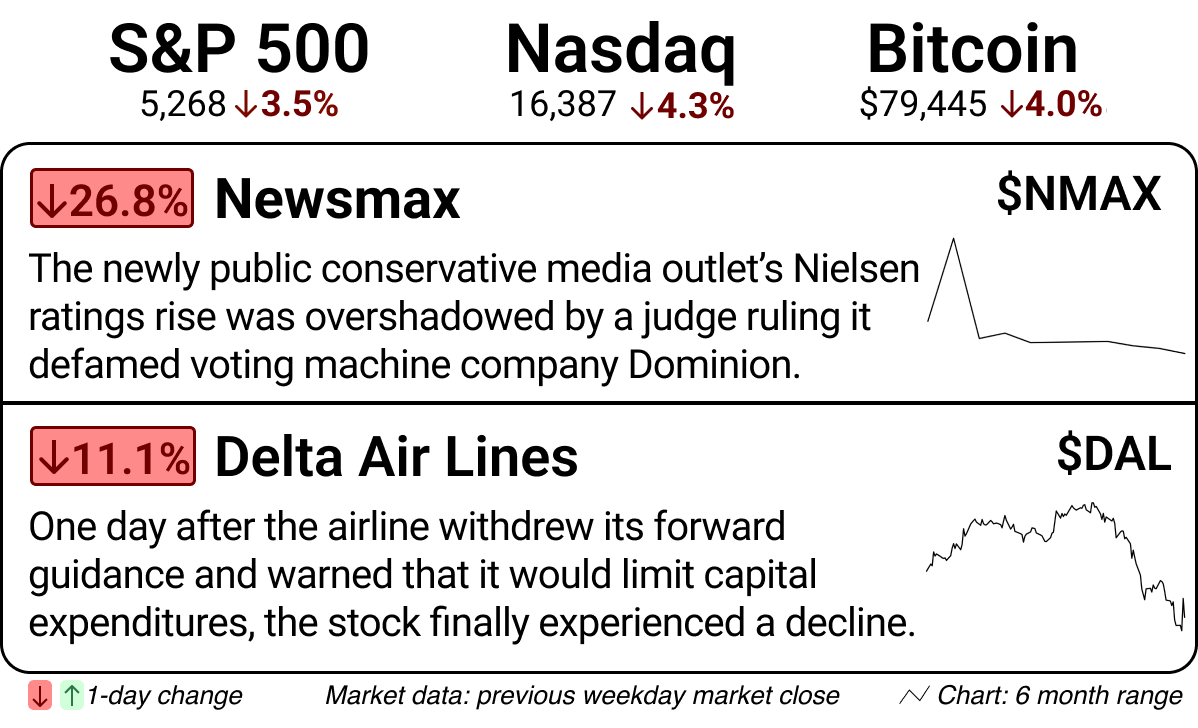

JOE'S MARKET PULSE |

|

🔗 Newsmax / Delta |

A new chapter in home construction: No wonder 12K+ people recently invested in BOXABL. Their houses can be delivered to you and unfolded in one hour. Not to mention, they’ve incorporated automotive style manufacturing to housing. BOXABL can put out a home every 4 hours. Now, BOXABL’s preparing for Phase 2, combining modules into larger townhomes, single-family homes, and

apartments. Invest before their raise partially closes Monday.* |

Markets & EconomyBeer tariffs sour Constellation’s outlook: Modelo owner

Constellation Brands ($STZ) slashed its fiscal 2026 forecast amid Trump’s 25% tariff on imported canned beer. The company projected EPS of $12.60 – $12.90, well below analysts’ $13.97 expectations, sending shares down 3% in after-hours trading. [Read] Inflation cools before tariff storm

hits: CPI dropped to 2.4% in March, its lowest rate since September, as prices fell 0.1% month-over-month. The unexpected easing came just before Trump’s tariffs took effect, with economists warning the levies will soon reignite price pressures while slowing growth. [Read] JCPenney’s parent company cuts more jobs: Catalyst Brands is eliminating 9% of its corporate positions, marking the second round of layoffs since February. The newly formed retail conglomerate,

with $9B in revenue and 1.8K stores, cited optimizing structure as the reason. [Read] Business & WealthSilicon Valley’s $40B robot gamble: Figure AI sought funding at a staggering valuation despite having no revenue and few robots. Its founder claimed autonomous capability — leapfrogging Tesla ($TSLA) and Google ($GOOG) — despite only showcasing basic tasks at BMW’s ($BMWYY) facility. [Read] Algorithm locks prisoners out of parole: Louisiana’s TIGER risk assessment tool has barred thousands from parole consideration, including a 70-year-old blind prisoner. Critics said the system ignored rehabilitation efforts while perpetuating racial disparities in the justice system. [Read] USPS stamps set for record price hike: The Postal Service proposed raising Forever stamps by $0.05 to $0.78 starting Jul. 13. This marks the first of five planned increases through 2027 amid scrutiny from Trump’s Department of Government Efficiency. [Read] |

*Thanks to our sponsors for keeping the newsletter free. |

|

|

|

|

|

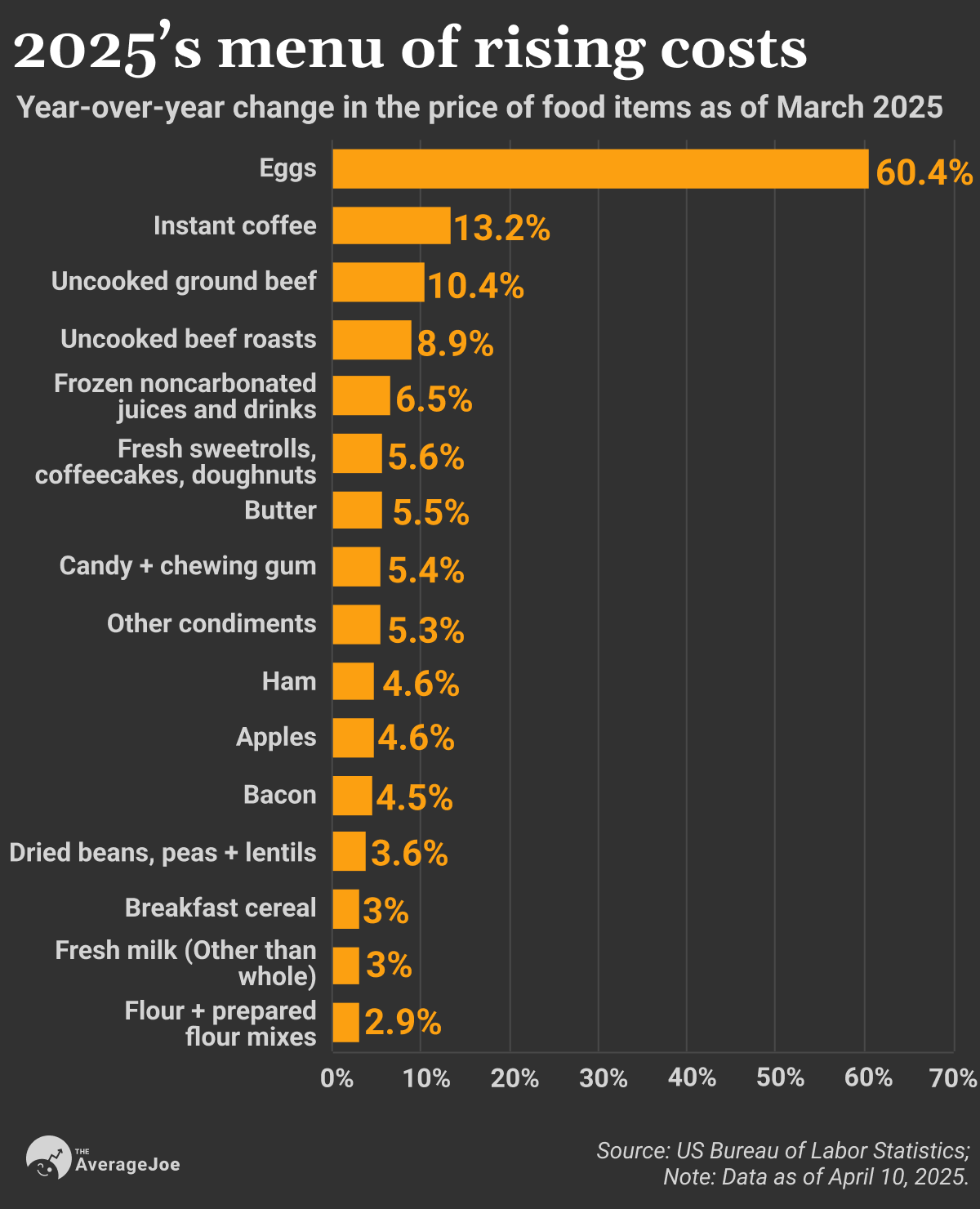

CHART OF THE DAY |

|

|

|

|

|

DIGIT OF THE DAY |

Prada’s $1.4B Versace Acquisition Defies Luxury Market’s Slump |

Italian fashion icons are playing chess while competitors play checkers. Prada Group ($PRDSF) announced Thursday it will acquire Versace from struggling Capri Holdings ($CPRI) for $1.38B, creating a formidable Italian luxury conglomerate amid a chaotic luxury market roiled by President Trump’s tariff policies. The deal showcases Prada’s growth as one of the rare success stories in the current luxury downturn where many brands in luxury retail face declining sales and consumer fatigue.

- Prada Group reported exceptional 2024 performance, with revenues soaring 17% year-over-year, powered by Miu Miu’s extraordinary 93% retail surge, while competitors faced declining sales.

- In stark contrast, Capri Holdings expects Versace revenues to drop to $810M in its current fiscal year, down from $1B in 2024, highlighting the brand’s desperate need for reinvention.

Made in Italy renaissance: The acquisition represents a second chance for Prada at brand portfolio expansion after failed attempts with Jil Sander and Helmut Lang in the early 2000s. Prada Group’s CEO Andrea Guerra noted, “Versace has huge potential,” while acknowledging “the journey will be long.” This deal signals Prada’s ambition to create an Italian competitor to French luxury giants LVMH ($LVMUY) and Kering ($PPRUY), bringing together complementary brand identities under one umbrella. Despite their differences in style, both share commitments to Italian craftsmanship, creativity, and family legacy values that could make this acquisition succeed where previous attempts failed. |

|

|

|

|

EXTRA JOE |

|

|

|

|

|

|

|

BOXABL Disclosure: **This is a paid advertisement for Boxabl’s Regulation A offering. Please read the offering circular at https://www.boxabl.com/invest/#circular All content provided by The Average Joe is for informational and educational purposes only and should not be taken as trading or investment recommendations.

The Average Joe Media Inc. 800 Third Avenue FRNT A #1196

New York, NY 10022

United States

Unsubscribe here

|

|

|

|

|