View in browser |

|

Good morning. In response to Trump’s ever-increasing tariff threats, Chinese factory workers are exposing “Made in America” claims on TikTok. This digital rebellion targets American brands like Michael Kors ($CPRI), Coach ($TPR), and Ralph Lauren ($RL) for manufacturing in China, undermining their on-shore claims. It turns out that the steep “American craftsmanship” markup often comes with a “Made in China” tag hidden underneath. |

|

|

|

|

|

AGRICULTURE |

Bayer Made Billions Off Roundup — But the Weedkiller Might Eliminate Operations Amid Lawsuits |

|

The world’s most popular weedkiller might get the job done, but 50 years after hitting the market, scientists are still unsure whether it’s safe. Every year, American farmers paint their fields with some 300M pounds of glyphosate — but its days may well be numbered. That’s because, while the US Environmental Protection Agency (EPA) says it’s “not likely” to be carcinogenic, the World Health Organization’s IARC holds that it’s “probably carcinogenic to humans.” And where there’s ipsum area, there are ample opportunities for interpretation. ipsum area: In 2018, the same year as longtime Roundup owner Monsanto sold to German pharmaceutical company Bayer ($BAYRY) in a $63B deal, a California judge ordered the company to pay $289M to a school groundskeeper who alleged the weedkiller caused his cancer. The court’s nod, which came just a year after California’s Office of Environmental Health Hazard Assessment placed the chemical on its Prop 65 list following the IARC’s recommendation — cleared the way for thousands of litigants to pursue similar claims.

- While Bayer holds that Roundup is safe and cites the EPA’s determination, it has paid over $10B in payouts to plaintiffs over the last decade — and has set aside more than $5.9B more to settle 67K+ pending cases.

- The cost of litigation has largely offset the product’s revenue — Roundup made $2.8B for Bayer last year, barely breaking even, per CEO Bill Anderson.

Bye-Bye, BayerBayer’s acquisition of Monsanto is now considered one of the worst buyouts in history, in part because the weight of Roundup has sunk not just the crop sciences division of the German business but its total value. Bayer’s market cap has fallen to €19.8B ($22.4B) — a pittance of what it paid. And saddled with uncertainty, it might have to cut its losses.

- Bayer warned in March that it might stop selling Roundup entirely, citing a lack of “regulatory clarity” that has allowed litigants to cite state rules despite EPA approval.

- The move would upend the US agriculture market, which is not just heavily reliant on the weedkiller but also on glyphosate-resistant seeds sold by the company.

Forward-looking: Bayer says that it hopes to “significantly contain” litigation by 2026, per Reuters. And barring federal protections, Bayer could be angling to settle its outgoing suits for significantly less on appeal — then exit the US market entirely. In its absence, it’s hard to tell what could replace the legacy herbicide — as WSJ notes that it’s unlikely any American firm would pick up production or any competitor would seek to make a replacement product. With few other options, the end of the Roundup era could stand to further complicate an already-complicated US agriculture business. |

|

|

|

|

PARTNERED WITH AMASS |

Rosé Can Have More Sugar Than Donuts? |

|

No wonder 38% of adults prefer health-conscious beverages. Meanwhile, companies like AMASS Brands are raking in sales by tapping into this trend — creating a huge opportunity for

investors. AMASS earned $33M in 2023 alone thanks to products like their top-selling zero-sugar Summer Water rosé (it’s tariff-free, too). That’s just one of their portfolio’s 15+ diverse brands, already distributed across 40K+ retail locations, including Whole Foods, Erewhon, and more. It’s only the beginning. They have another new product announcement just around the corner. And by 2028, AMASS plans to ~3X their retail footprint. Plus, celebs like Adam Levine and Derek Jeter have already invested. You can, too — but only days remain before this early-stage opportunity ends. Lock in your stake while you can |

|

|

|

|

|

LARGECAP RECAP |

💱 Trump Admin Creates Electronics Exemption to 145% Chinese Tariffs |

Americans will have to wait a little longer before it assembles an “army of millions and millions of human beings” to screw in little screws to make iPhones. That’s because the US’ 145% tariff on Chinese goods has a glaring new exemption — electronics.

- The exemption will prevent consumer electronics companies like Apple ($AAPL) from bearing the weight of the US-China trade war — its stock rallied 2.2% on Monday.

- Other hardware manufacturers like Dell ($DELL), Western Digital ($WDC), and Texas Instruments ($TXN) rallied on the news, benefiting from the broad exemptions.

But it’s all temporary: Although some panicky consumers might feel buyer’s remorse, Commerce Secretary Howard Lutnick says that the pause is temporary — meaning that the return of sky-high tariffs on Chinese tech imports could only be a matter of time. And with the US and China not cooperating on trade talks in any form, it might be sooner rather than later as China responded to US pressure this weekend by suspending rare earth and critical mineral exports to the States. |

|

|

💰 Goldman Sachs Trades Its Way To Earnings Beat Amid Trump Trade Tensions |

|

|

While the S&P 500 tumbled 8.12% this year, Goldman Sachs ($GS) recast Q1’s decline into dollars. The Wall Street giant’s equity trading desk capitalized on the volatility, driving a 14.3%

earnings beat that propelled quarterly profits up 15% from last year to $4.74B. Despite the windfall, the news plasters over softening divisions elsewhere.

- Goldman’s 27% surge in equity trading revenue to $4.19B outpaced analyst expectations by $540M — while the firm’s overall revenue hit $15.06B vs. the $14.81B expected.

- However, CEO David Solomon warned of “a markedly different operating environment” heading into Q2 amid intensifying trade tensions — a softer message than the dire warnings issued by other bank CEOs last week.

Divergent divisions: While Goldman’s trading desk feasted on volatility, other divisions starved, with investment banking advisory plunging 22% and asset management slipping 3% to $3.68B. The institution is also stepping away from its consumer banking push as it winds down its Apple ($AAPL) card partnership. Otherwise, $GS posted a record $3.17T in assets under supervision — considering itself a safe house in the eye of Trump’s tariff tornado. |

|

|

|

|

|

|

|

JOE'S MARKET PULSE |

|

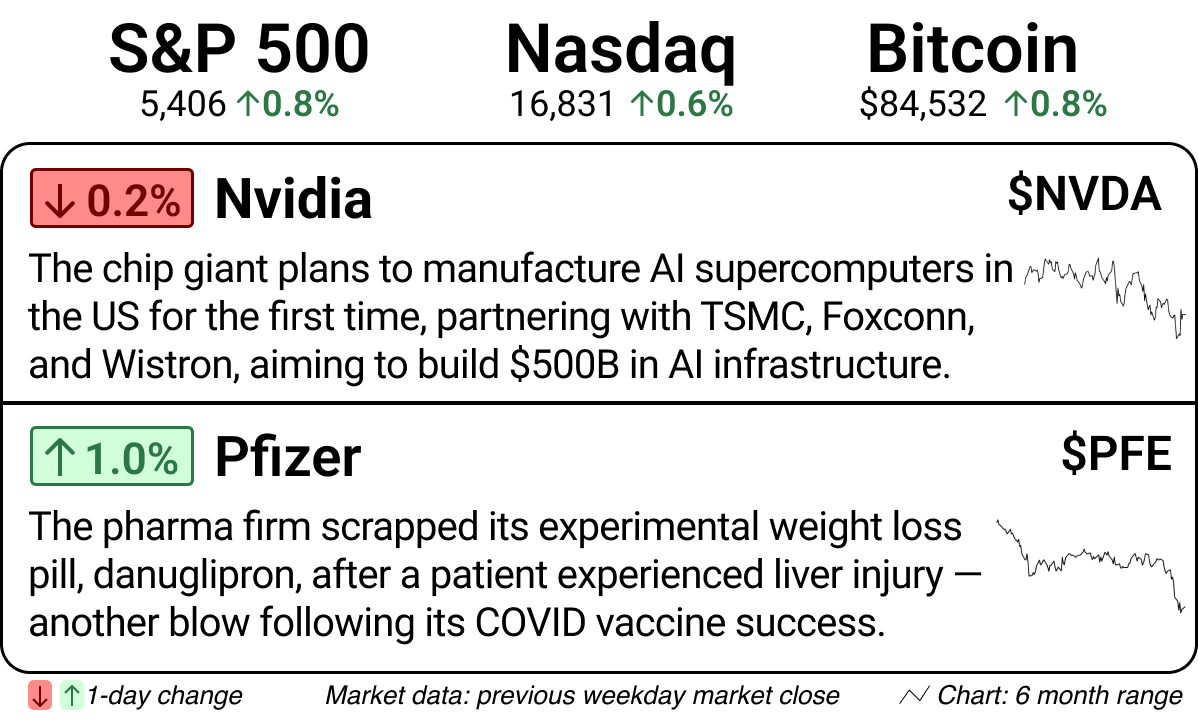

🔗 Nvidia / Pfizer |

While everyone else is holding and hoping, miners are locking in real returns: Blockware makes it insanely easy to start mining Bitcoin without any tech skills or hardware. Your miner runs in a US facility, earning Bitcoin daily — at a cost far below market price. Buy, sell, or scale rigs anytime through the Blockware Marketplace. It’s hands-off, flexible, and built for long-term gains. Use Code ‘AJ100’ for $100 off your first Bitcoin Miner.* |

Markets & EconomyOPEC slashes oil demand outlook despite output hike: The oil

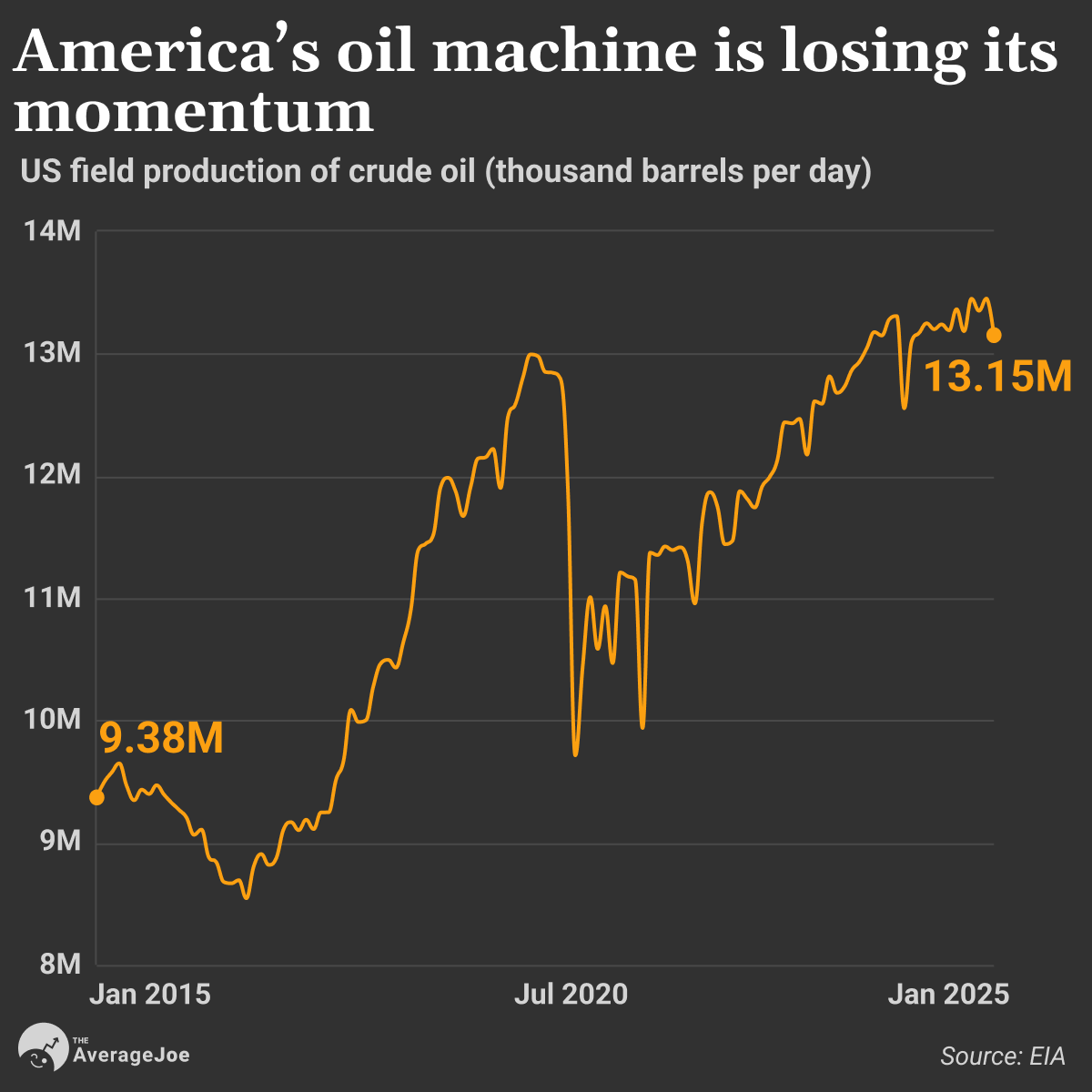

cartel reduced its forecast for oil demand growth due to US tariffs’ impact. OPEC now expects demand of 1.3M barrels per day this year, down from 1.45M, while Brent crude traded around $65. [Read] US airport arrivals in sharp decline: Daily data revealed a rapid drop in arrivals at the top 10 US airports since late February, reflecting decreases in business travel, tourism, and government travel according to Apollo Global Management’s ($APO) analysis. [Read] Consumer sentiment plummets on tariff fears: US consumer confidence plunged for the fourth consecutive month in April, with inflation expectations soaring to 6.7%, the highest since 1981. Sentiment dropped 30% from December as recession fears mount. [Read] Business & WealthHackers attack dialysis firm operations: DaVita ($DVA) discovered on Saturday that parts of its network were encrypted by attackers. The kidney-care company isolated affected systems and implemented interim measures but couldn’t estimate the duration or severity of the disruption. [Read] Chinese battery giant reports surging profits: CATL’s Q1 net profit jumped 32.9% to $1.91B, its fastest growth in nearly two years. Revenue increased by 6.2%, ending five quarters of decline as the EV battery maker prepares for a $5B Hong Kong listing. [Read] US oil production growth threatened by price slump: Analysts warned that output might decline this year

due to falling prices and tariff uncertainties. The Energy Administration lowered its production growth forecast to 2.2% as WTI crude traded at $62.43, below profitable drilling thresholds. [Read] |

*Thanks to our sponsors for keeping the newsletter free. |

|

|

|

|

|

CHART OF THE DAY |

|

|

|

|

|

DIGIT OF THE DAY |

Waymo Robotaxis Capture 20% of Uber’s Austin Market Share Within First Month |

Driverless taxis are no longer a futuristic fantasy — they’re carving out the new normal for commuters. Since launching in Austin, Texas, last month, Waymo’s autonomous vehicles have accelerated to capture ~20% of Uber’s ($UBER) rides, according to YipitData. The adoption rate demonstrates how quickly consumers are embracing driverless technology when conveniently integrated into rideshare apps.

- Waymo’s Austin launch outpaced its previous market entries, accumulating 80% more driverless rides during its first 27 days than it did during the equivalent period in San Francisco.

- Despite running only in a 37-square-mile zone in Austin, Waymo hit the same market share Lyft ($LYFT) had in parts of San Francisco by last November.

The road ahead: While Waymo currently leads the US autonomous vehicle race with operations in five major markets (Phoenix, San Francisco, Los Angeles, Austin, and parts of Silicon Valley), competition looms on the horizon. Industry analysts suggest the global robotaxi market has room for multiple winners, with potential future rivals including Tesla ($TSLA), Amazon’s Zoox ($AMZN), and international contenders like Baidu ($BIDU). Waymo’s parent company, Alphabet ($GOOG), looks well-positioned to maintain its market leadership as the driverless shift picks up speed. According to a16z’s Alex Immerman, customers are choosing Waymo despite long wait times for its “clean, quiet, and premium experience” — showing that quality, not just novelty, is fueling adoption. |

|

|

|

|

EXTRA JOE |

|

|

|

|

|

|

|

AMASS Disclosure: This is a paid advertisement for AMASS Regulation CF Offering. Please read the offering circular at invest.amassbrands.com. Blockware Solutions Disclosures: All content is for informational purposes only. Blockware Solutions, LLC, its affiliates (including but not limited to Blockware Intelligence, and their respective directors, members, shareholders, officers, managers, employees, and agents (collectively, “Blockware”) disclaim any liability or responsibility for the use of or reliance on any information contained in this communication. Blockware is not a law firm, accounting firm, tax advisor, or financial advisor. In addition, Blockware does not provide legal, tax, accounting, business, regulatory or financial advice and does not represent that outcomes described herein will result in any particular investment or tax consequence. Blockware recommends that prospective customers confer with

their personal or independent financial and tax advisors about their particular circumstances prior to using or relying on any information contained herein. All content provided by The Average Joe is for informational and educational purposes only and should not be taken as trading or investment recommendations.

The Average Joe Media Inc. 800 Third Avenue FRNT A #1196

New York, NY 10022

United States

Unsubscribe here

|

|

|

|

|