We love email marketing here at MailCharts. Marketers who use email responsibly have direct access to their ecommerce customers in one of the most valuable access points: the inbox. Email is easily tracked and measured, so marketers know right away how well their campaigns are performing.

And you can’t beat email for return on investment, either.

But you need a solid grounding in the fundamentals of ecommerce email marketing principles if you want to succeed. That’s what this ultimate guide will deliver. Use it to understand email marketing best practices, what kinds of emails to include in a well-rounded email marketing program and how to measure success. Jump to any section here:

- What is ecommerce email marketing? A high-level overview

- Types of emails for ecommerce

- Email marketing best practices

- Measuring success: What email marketing metrics should you track?

- Additional resources

What is ecommerce email marketing?

Ecommerce email marketing is the method of using email to generate sales for an online ecommerce operation. It is part of an overall digital marketing strategy.

Before diving into the nuts and bolts of ecommerce email marketing, let’s explore the role email marketing plays within your global marketing strategy.

At its core, email is a communication channel. Email allows you to build relationships with current and potential customers over time. The most effective way to ensure that subscribers open your emails tomorrow is to send great emails today. Email is not just a promotional megaphone.

As we’ve seen, email is extremely versatile. That’s a great power but it also means you’ll have to optimize a wide range of marketing messages. Ideally, you start by setting up the necessary transactional emails and then add one type of campaign at a time.

Don’t try to build a welcome campaign, a series of educational content, and a sequence of abandoned cart emails all at once. Trying to plan multiple email marketing initiatives at once is akin to trying to plan a wedding, a birthday party, and a bar mitzvah all during the same week. Not a good idea.

Start small and grow your email marketing program over time.

Email marketing for ecommerce is sexy. Why?

Your email list is a highly valuable business asset, even though it’s not visible on the books, from an accounting standpoint. Recent changes in the PPC and social media landscape have made it even more lucrative to focus on email marketing.

Just to give you some context, the average CPC for Google Ads is now $2.41.Facebook’s organic reach (the percentage of people that see your posts without paying to increase distribution) dropped to an all-time low of 2.6%, and Tweets’ click-through rates are generally in the 0.5% range.

Compare this to the typical email marketing metrics. What do you get on your campaigns? A 20% open rate and a 3% CTR?

That’s an 8x better performance on reach and a 6x better performance on clicks when compared to social media.

Oh, and remember, you own your email list. If you don’t do anything spammy, no amount of “algorithm change” will drastically affect you. Take that, Facebook Newsfeed!

The only way to compensate for the lower organic page reach on social media is to spend more money on ads. Then simple arithmetic kicks in: as more marketers increase their spend, CPCs rise, which decreases your ad campaign’s ROI.

Let’s put these numbers into context with an example.

Imagine that you have an email list of 100,000 subscribers and your emails receive a 20% open rate, with a 3% click rate. Sending an email drives 3,000 visits to your ecommerce site. Given the visitors’ high intent (they are on your list AND they clicked through your email), let’s say they convert at 3%. In total, this email marketing campaign would drive 90 sales.

Now let’s say that you want to get the same 90 conversions using Facebook. Assuming a $1 CPC and a first-time visitor conversion rate of 1%, you’d need to pay $9,000 to drive 90 sales.

This insight — that email is a phenomenal channel to focus on compared to social media — is supported by a study from McKinsey revealing that email is 40× more effective at acquiring new customers than Facebook or Twitter.

Now that you’re convinced that you should focus your energy on sending emails instead of advertising on social, let’s talk about the role email marketing can play.

Most marketers use email as a retention channel — to keep customers around — but email marketing can be a powerful acquisition tool too, driving website traffic and helping you convert prospective buyers into paying customers. In essence, a good email program works as a conversion tool, increasing your overall site’s conversion rate.

Another reason for email’s popularity growth in recent years is how cost-effective it has become Back in the day, to send emails you had to set up your own email servers, and worry about downtime and deliverability. Security was also an issue. This was a complex and expensive process.

Now, you can choose between many quality email service providers (ESPs), sign up for the email marketing tool of your choice, and get rocking.

Types of emails for ecommerce marketers

Great news: you can create and schedule all of the most important ecommerce emails you can be sending as an email ecommerce marketer as automated emails.

When you do this, keep in mind that each email should have a clear business goal, provide value to the end-user, and have a call to action describing the next action the reader should take.

Also sure each email focuses on only one thing. Don’t lump a sale with a product announcement with your latest blog post.

We’ve gathered some of the most effective types of campaigns below. Note that there is some overlap between certain email types (e.g., is a newsletter with a discount the same as a sales and promotion email?). However, the specific details of “how should we classify this email” aren’t as important as understanding the different ways you can use email to drive value for your business.

Here are the different ecommerce email types we’re about to explore:

- Sales and promotions

- Product announcements

- Welcome emails

- Surveys

- Birthday emails

- Cart abandonment

- Browse abandonment

- Purchase confirmation

- Shipping confirmation

- Replenishment series

- Back in stock

- Wish list sale

- Time-sensitive deals

- Loyalty programs

- Cross- and upsells

- Win-back emails

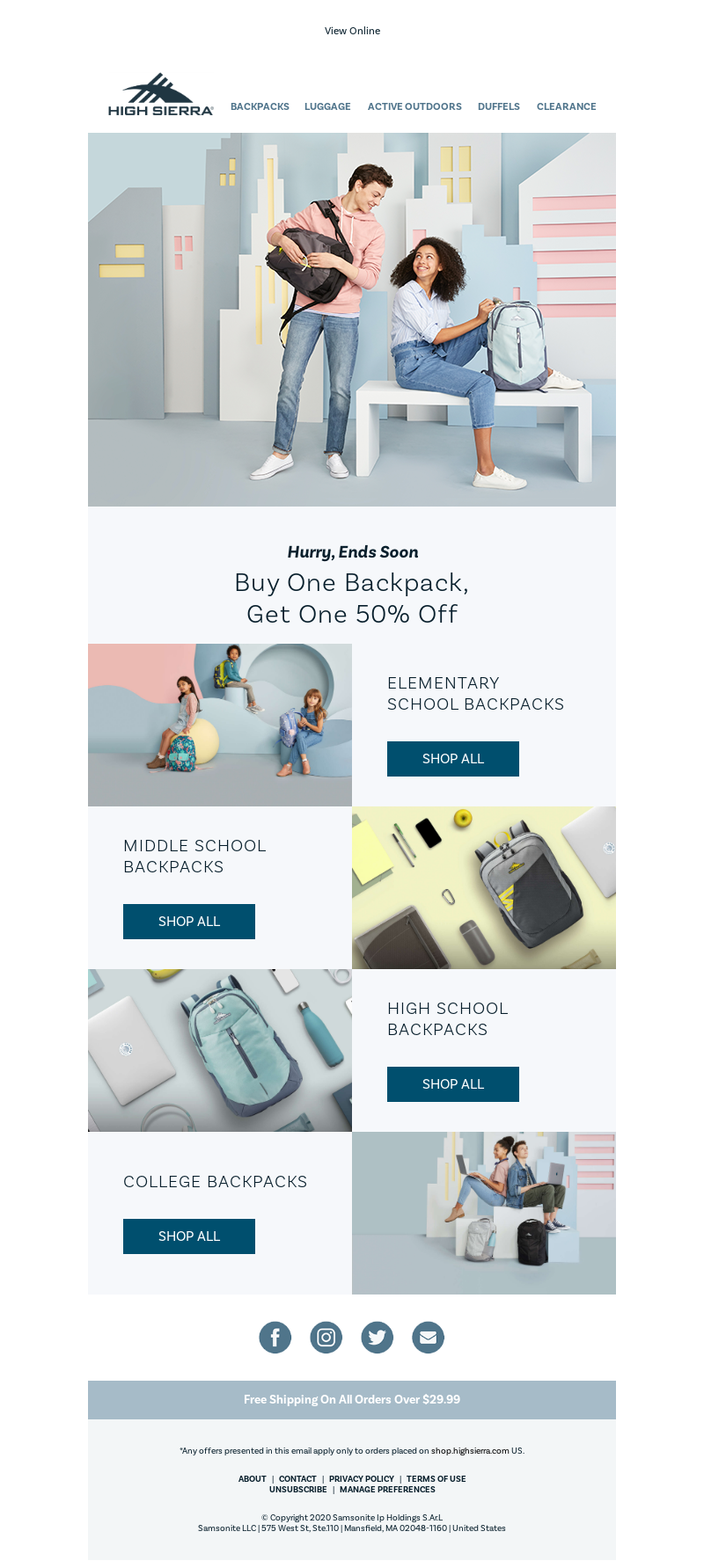

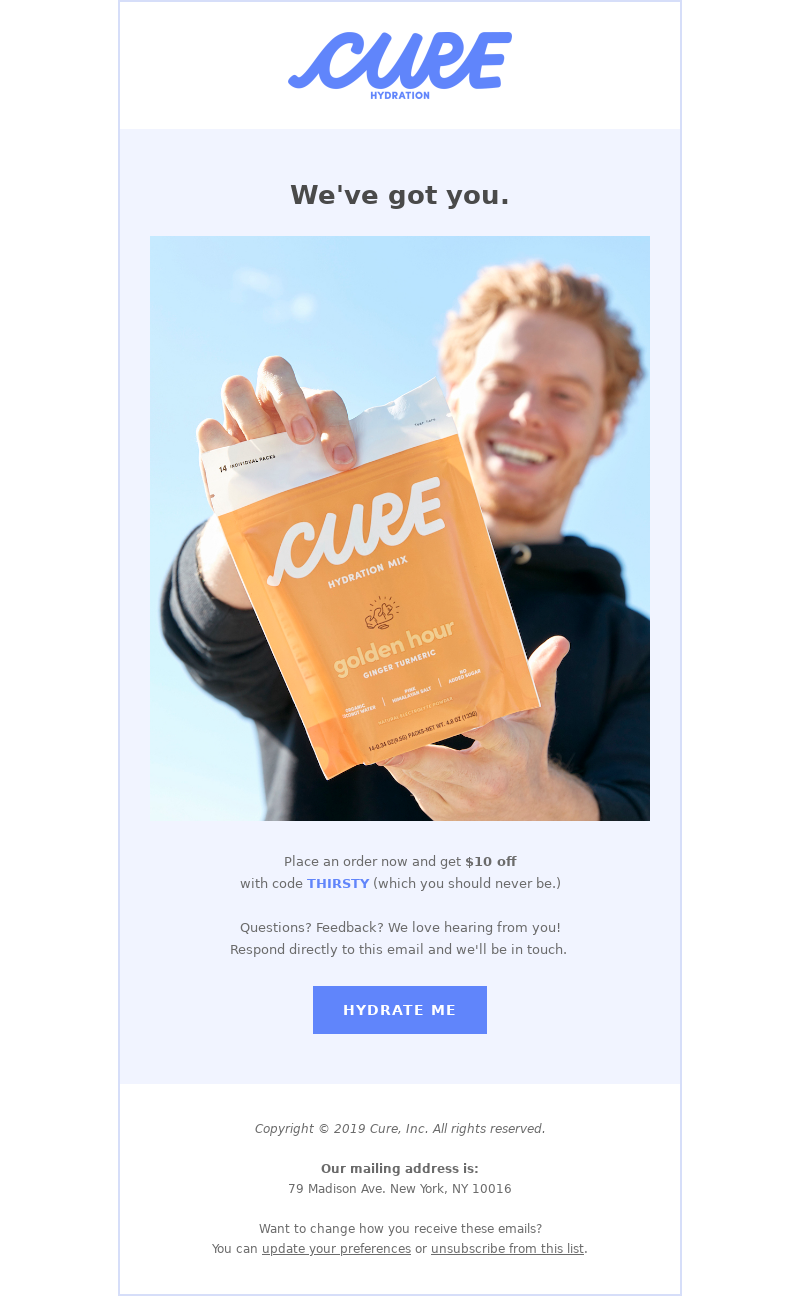

Sales and promotions emails

Sales and other promotional emails offer a discount or other type of offer to bring email subscribers to the brand’s online store to shop. They’re a highly popular type of email marketing campaign.

Why use them?

To drive sales. Be careful, though. Running promotions and sales will boost sales in the short term, but can hurt you in the long term if you overdo it.

Once you’ve given a discount, there isn’t much more you can give (other than another or a steeper discount). You don’t want your email subscribers to buy only when you’re discounting.

When to send them?

Special occasions and holidays such as Black Friday, Cyber Monday, and the New Year are great times to send promotional e-commerce emails. The start of a new season is a great opportunity for an ecommerce business, too, as are offbeat holidays or events like Pi Day (March 14, or 3.14) and Star Wars Day (May 4, or “May the Fourth (Be with You).) If you’re behaviorally targeting users and creating segments based on intent, sales promotions delivered to high-intent customers are a solid strategy as well.

Pro tips

- Include an expiration date or a real-time tactic like a countdown clock to provide a sense of urgency

- Include any industry must-haves (e.g., offer free shipping for ecommerce or XX days 100% satisfaction guarantee for SaaS businesses)

- Heavily split test your subject lines and how you position your offer (e.g., percent off vs. dollars off)

- Note: There’s some research on this called the Rule of 100. When something costs under $100, percentage discounts seem larger than absolute ones. For goods over $100, absolute discounts seem larger than percentage ones.

- Segment your list and provide different discounts to loyal customers than to potential new buyers. Yes, you can send the same deal to everyone, but just because you can doesn’t mean you should. For example, it may take a large discount to convert a prospective customer (first-time purchaser), while a smaller discount may be enough to get an existing customer to buy again. It may take even less of a discount to convert frequent purchasers. You should test accordingly and use this to your advantage.

Product announcement emails

Product announcement emails are marketing emails that include news about product launches, new collaborations, and events.

Why use them

To announce what your brand has been up to. Think of these as extremely focused newsletters. Use this type of email to drive the first wave of user adoption. From promoting a new feature to selling new products, the use cases are plenty.

When to send them

When you’ve accomplished something special (e.g., launched an Android app) or launched a new product.

Pro tips

- Include only one, really clear, CTA.

- Make your reader feel special—that they’re the first to hear about this.

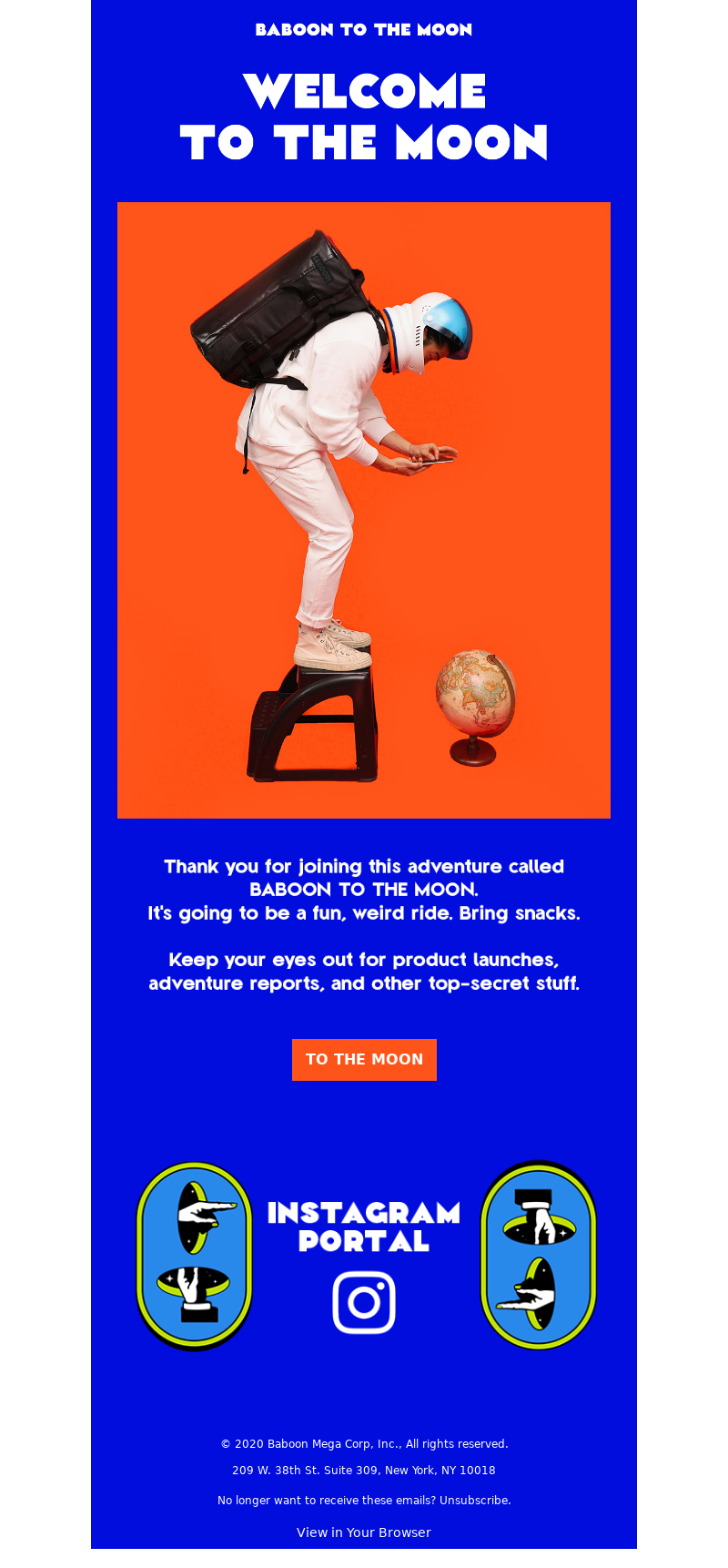

Welcome emails

Make sure new subscribers feel appreciated by sending them a great welcome campaign.

Why use them

The welcome email is a must. Anytime someone subscribes to your website, newsletter, or service, you should send a welcome email to confirm they’ve successfully joined your list.

Welcome emails typically have among the highest open rates, so make the most of your welcome email to keep subscribers engaged going forward.

The true welcome email is often only sent after a user has confirmed their email address by clicking a confirmation button in an automated email (double opt-in). You can use it to

- establish credibility by including logos of companies that use your product or service

- get the subscriber incested by sharing your brand story

- offer a discount code to incentivize a user’s first purchase

- get a user to take the next step in your customer journey (e.g., “take a style quiz” or “finish setting up your profile”)

When to send them

Send a welcome email right after someone joins your product, service, or website. This should be the first email a new subscriber gets from you after the “click to confirm” email – unless they’ve made a purchase before, in which case they’ve already received some of your transactional emails.

Pro tips

- Keep your welcome email as simple and clean as possible. Have only one CTA and make it prominent.

- If applicable, include a discount code in your welcome email to encourage new subscribers to make their first purchase (you can also wait 24 hours before sending a discount code, in case they’re planning on purchasing right away). You can even advertise the discount as an incentive to get people to sign up.

- Use the data your existing customers give you from introductory efforts like style quizzes or profile/preference-setting to segment them and/or send personalized messages.

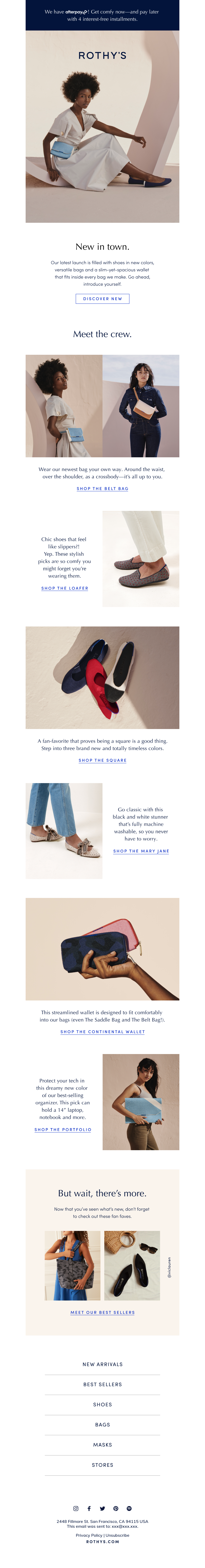

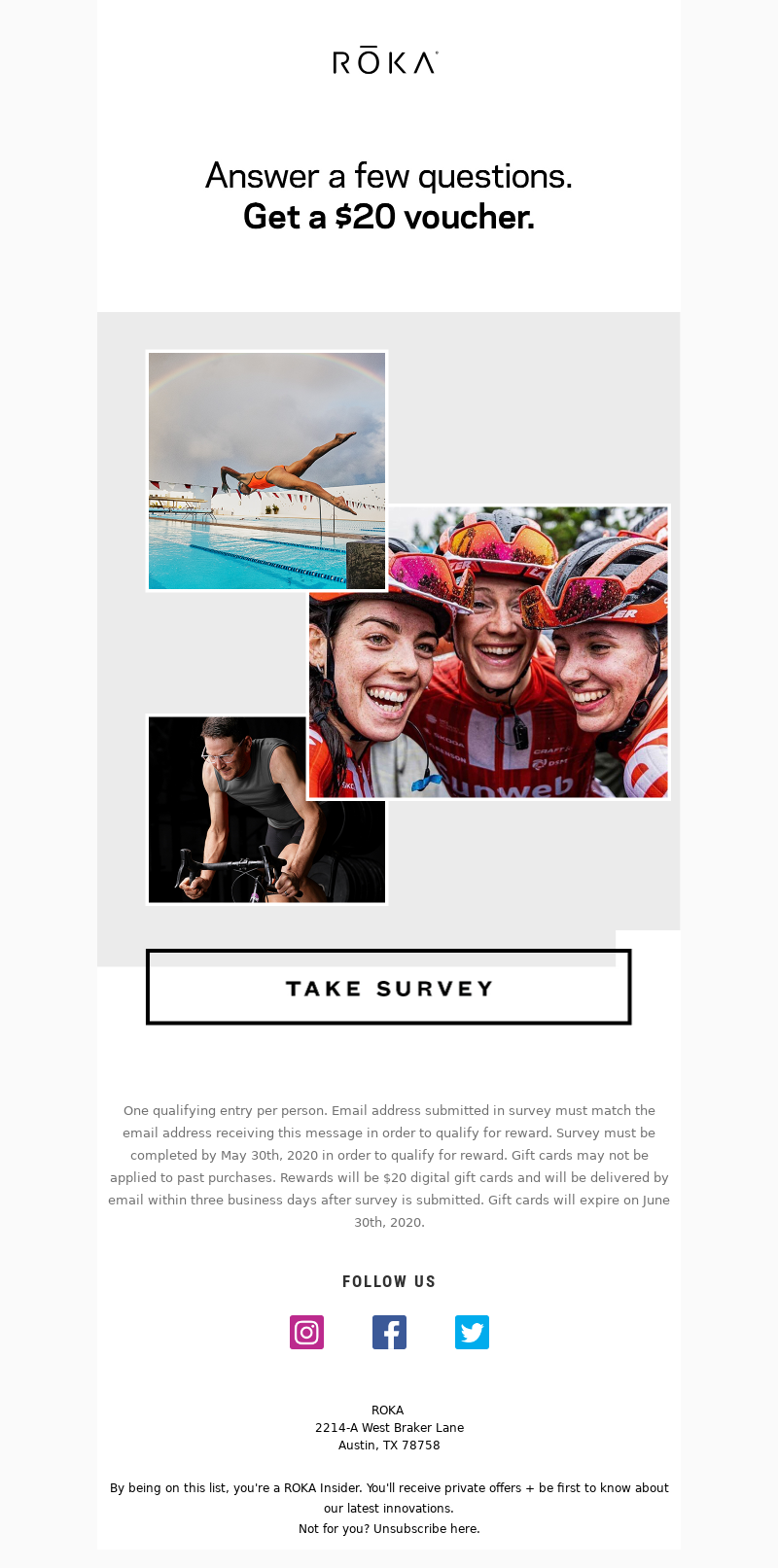

Surveys

Better understand your customers and get valuable feedback on products with survey emails.

Why use them

Surveys or customer feedback emails help you understand your customers and get a sense of your net promoter score (a common measure of customer satisfaction).

When to send them

Whenever you have a list of questions you wish you could answer, you can send a survey email. Limit these emails to once a quarter max—otherwise, it’ll get annoying for your subscribers. If you need fresher data, limit the survey email to one or two questions.

An exception is when you want to send customers a review request for a product they’ve just purchased. Send these types of review request emails once the customer has had enough time to test your product.

Pro tips

- Make sure your survey email has a single theme (e.g., don’t ask about new feature suggestions AND feedback for purchase experience in the same email).

- Surveys are, by nature, all about you. Incentivize your users to respond by offering them a discount, gift card, raffle, or other goodie.

- Also, keep your surveys short: 3 minutes max (less than 1 minute is ideal). If your survey is really short (and it should be), call this out in the email to set expectations.

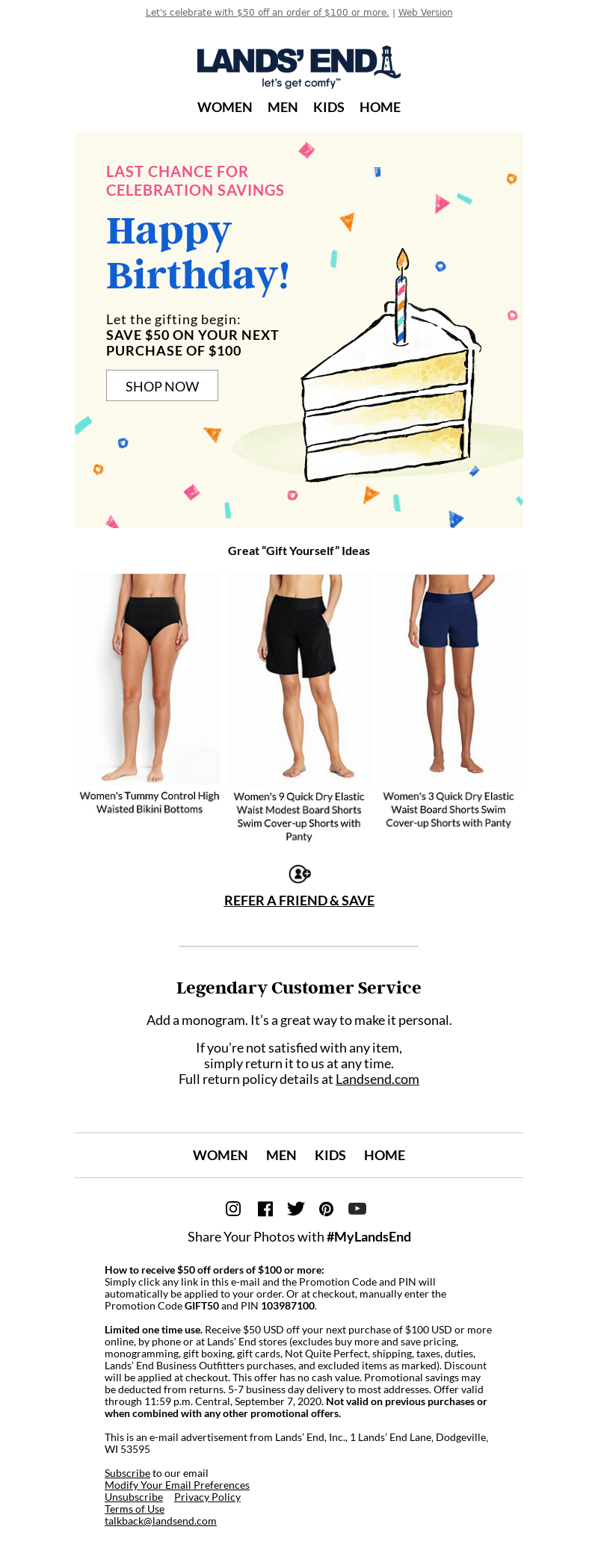

Birthdays

Recognize your customers with a special Birthday email on their big days.

Why use them

Birthday emails give e-commerce stores a unique opportunity to engage with their customers on a more personal level. If you’re a high-frequency sender, you can easily substitute a birthday greeting for a regular promotion without reducing your marketing effectiveness or cutting into revenue.

When to send them

Some brands send emails in a batch at the start of the month. Others send them a week or so in advance to give recipients more time to use them or on the day itself. Your ESP and data integration capabilities will play a big part in setting up your sending schedule.

Pro tips

- Begin collecting birthday data with your opt-in form or as part of your welcome message or onboarding journey. Be sure to explain why you’re asking for their birthdays and what you’ll send them.

- Celebrate with a free gift or generous discount if your profit margin allows it – or just send a thoughtful, personalized greeting.

- Keep the message focused on your birthday greeting – don’t clutter it up with competing promotions.

- If you send a gift or incentive in your birthday greeting, include an expiration date and send a reminder email a day or so before to encourage them to use it.

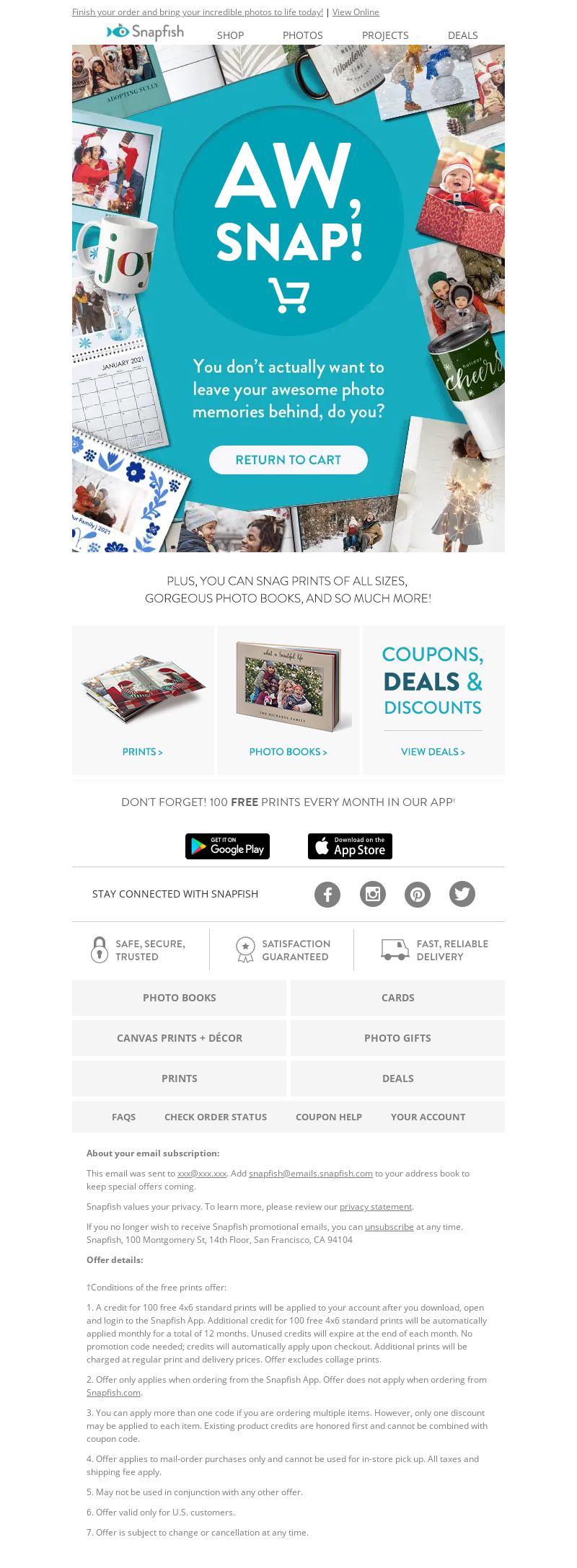

Cart abandonment

Send reminders to potential future customers who’ve added products to their carts but did not complete the purchase. These cart abandonment emails have a high chance of success of turning cart abandoners into buyers and thus tend to be very valuable, especially in the ecommerce world.

Why use them

The average person gets 1 interruption every 8 minutes, approximately 7 interruptions per hour, or 60 interruptions per day. The average employee gets interrupted 56 times a day. Needless to say, we get distracted a lot.

The problem with these distractions is that if they happen while a prospective buyer is adding items to their shopping cart, there’s a chance they’ll get busy and won’t complete the transaction.

This is where the abandoned cart email comes in.

strategy

Cart abandonment emails allow prospective buyers to resume the shopping experience.

Another shopping behavior is that people like to comparison-shop. They’ll add similar products on competing online stores to see how much a purchase would cost including shipping.

Last, but not least, it’s worth noting that some visitors may be comfortable browsing on their mobile devices (e.g., on the commute to and from work) yet are more willing to complete the purchase later, once they’re in front of their computers.

When to send them

Send a cart abandonment email as soon as 15 minutes after a cart has been abandoned. One hour or 24 hours are two other popular time frames.

Pro tips

- Send cart abandonment emails! Seriously, do it. Over 68% of transactions are abandoned. A cart-abandonment series can pay off, too. Check the stats: 45% of cart abandonment emails are opened. 21% of all are clicked on, while 50% of the users who clicked purchased.

- Include popular or related items—if I leave a coffee machine in my cart, follow up and include the coffee filters, too.

- Create a drip sequence to send more than one email—you can provide steeper discounts over time or even wait to send a discount until later in the sequence. A popular approach is to use a discount ladder where no discount is offered in email 1. Email 2 offers 10% off, while email 3 offers 15% off (for example). You should test these different approaches, and discount percentages, to see what drives the most sales without hurting your margins.

- You can also leverage the scarcity principle by saying there are only X items left or that your cart expires in Y hours. If you work in the airline or ticketing business, you can mention that prices are likely to go up in the near future.

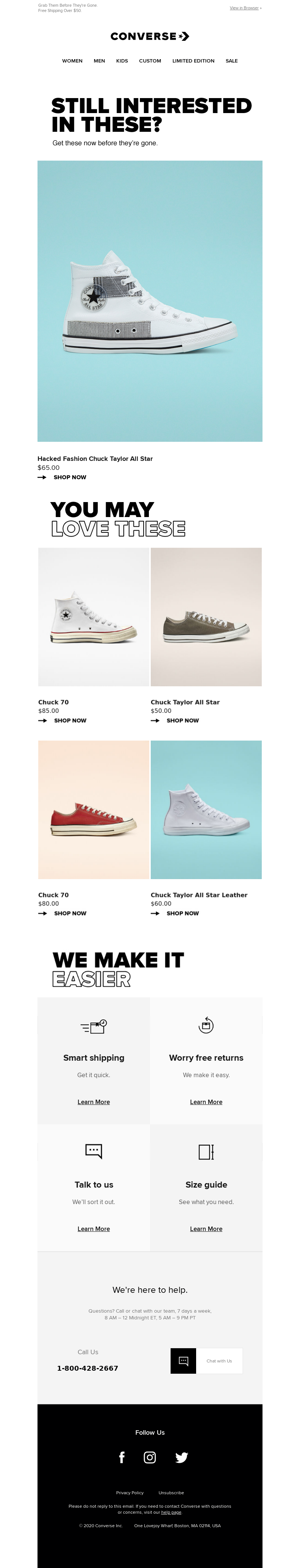

Browse abandonment

Shoppers abandon your online store for many reasons: they didn’t find what they were looking for, the user experience wasn’t great, or maybe they just ran out of time or were interrupted. Whatever the reason, a browse abandonment email allows you to remind people of your offer and invites them back to your store.

Why use them

Your online store experiences a higher volume of browse abandonments than shopping cart abandonment – more people look around vs. add something to their cart.

While the purchase intent of these visitors is lower than with shopping cart abandoners, some solid product suggestions might still get them to buy. That’s otherwise lost revenue that you’re now recuperating.

When to send them

A few minutes, to a few hours, after an engaged visitor leaves your website.

Pro tips

- Just like we saw in cart abandonment, don’t feel obligated to offer a discount. This email can simply be around “Where did you go?” asking if they’re still interested in item_1, item_2, and item_3.

- Mention that they can reach out with any questions.

Order confirmation

Everything you do in marketing boils down to this one moment when the customer purchases. Treat your order confirmation email with the utmost importance it deserves.

Why use them

It’s not uncommon for shoppers to get nervous when buying online, particularly those customers who did not grow up with the Internet at their fingertips.

The purchase confirmation or order confirmation email helps reduce the anxiety associated with entering credit card information online. It’s a way for shoppers to confirm that everything went as expected: that they bought the right item, in the right size, and are shipping it to the right address.

When to send them

Send an order confirmation email immediately after someone completes a transaction on your website.

Pro tips

- Many companies send order confirmations separately from their core marketing ESP. This happens because many payment processors offer confirmation emails out of the box. The challenge is that purchase confirmation emails may look different from the rest of your emails—potentially feeling off-brand or of lesser quality than the rest of your marketing communications. If that’s the case, make sure to spend the time required to make these emails look good.

- Get feedback from your support team when creating this email. They’ll be able to tell you which questions come up frequently after someone purchases. Adding missing information to this email can help reduce support volume.

- Whenever possible, include a one-click “track my package” link where the tracking code is clearly visible. Sometimes this will be a separate email, though, which we cover next.

Shipping confirmation

Are we there yet? Is it here yet? Where did it go? The shipping confirmation email keeps your customers updated on the delivery process.

Why use them

Your customers bought something and they want to know where their packages are.

When to send them

Combine this email with the purchase confirmation (see above) or send it as soon as you have the package’s tracking number. If you’re sending two separate emails, make sure to point this out in the receipt email (which should go out the second the transaction is processed).

Pro tips

- This is a great email to promote your referral program.

- You can also use this opportunity to reinforce something important about your brand (e.g., our candle wax is 100% organic and every candle is handmade).

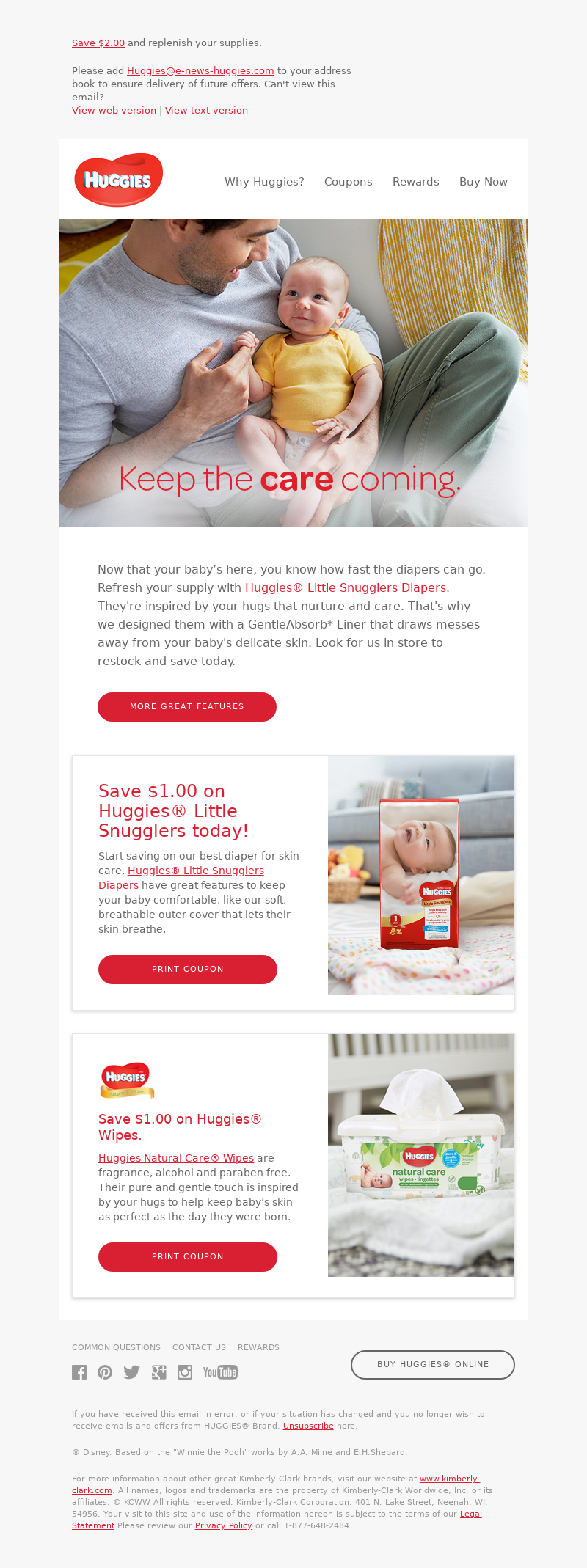

Replenishment series

“Are you ready to re-order?” Encourage customers to replenish a product with this popular automated email and turn them into repeat customers.

Why use them

There are so many things people continuously need. When you track customers’ purchase history, you can estimate when they’ll run out of something and remind them to restock. This does not only increase sales for you, it also helps your customers.

When to send them

The right answer will vary based on the product you’re selling. Send these when you know customers are running low.>

Pro tips

- This is a great email to upsell new product lines and popular items and to help customers discover something new.

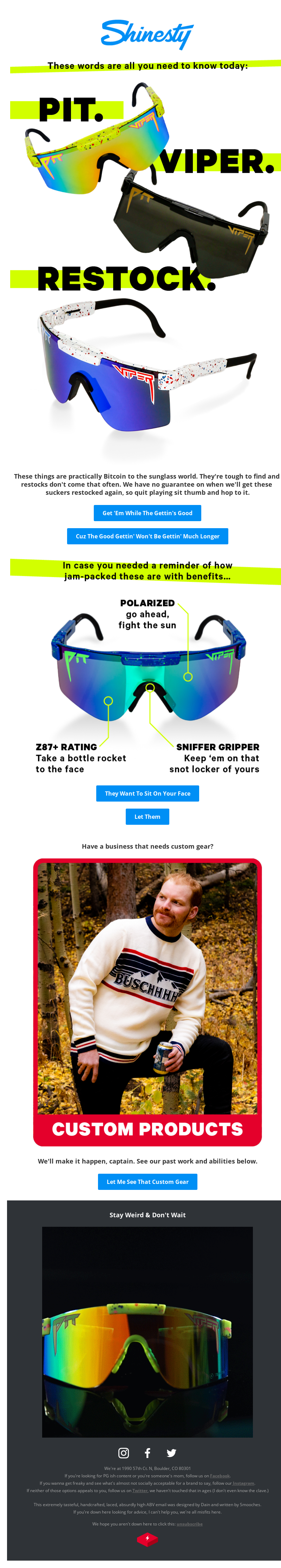

Back in stock

The name says it all. The product was once gone and it’s now available.

Why use them

Back in stock emails drive sales.

Segment your list to find previous buyers and offer them to buy this product again. Look for shoppers that have shared this item or those that have marked it as a favorite—if that’s an available option.

When to send them

Whenever you’ve replenished your stock.

Pro tips

- Use this email to make part of your list feel exclusive. Here’s a quick example: “Hey, Tom, just wanted to let you know that <product> is back in stock. You’ve been a loyal customer for two years and, to thank you for your support, you’ve received this email before 98% of our other shoppers. Thank you again for shopping with us.”

- Create urgency with your CTAs. For example, “Grab your Product_Name before we run out!”

Wish list sale

Whenever someone browsing your ecommerce store marks an item as a favorite or adds it to their wish list, that’s ecommerce marketing gold.

Use interactions like these to understand which products your website visitors like and leverage this in your email campaigns. If you have a site-wide sale and you know what products someone has marked as favorites, send them an email highlighting these products.

Why use them

Because the added relevancy drives more sales. You know what your subscribers are interested in.

When to send them:

Whenever you have a sale.

Pro tips

- Include some form of urgency. You know that the subscriber likes this particular item, so give them a little extra push to close the deal. This could be a mention of limited stock or a discount that expires.

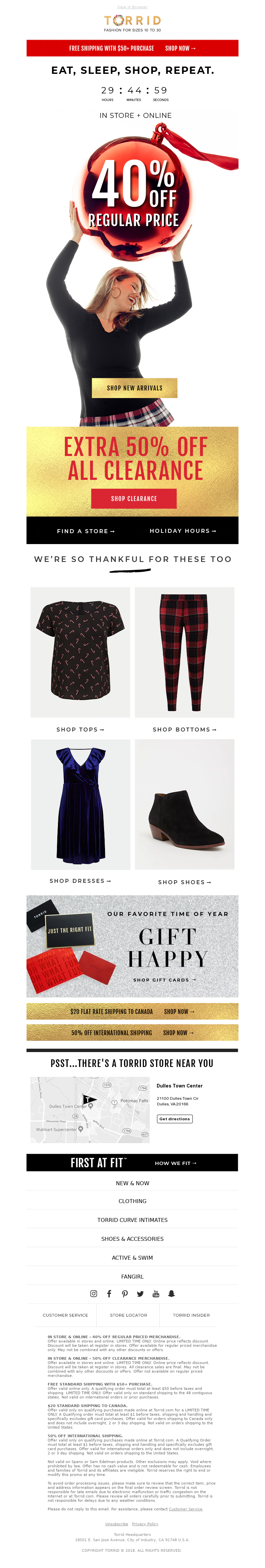

Time-sensitive deals

While most sales and other types of promotions have an end date to them, time-sensitive deals really focus on creating a sense of urgency in the recipient.

Why use them

To boost your revenue by driving more sales in a short time span. Be careful not to overuse this time of ecommerce email. If people notice that the same type of products are for sale many times a year, they won’t feel the urgency to get your deals anymore.

When to send them:

All year round. They also work great as part of a holiday or special occasion sale such as on Valentine’s Day or Black Friday. With many sales periods now starting days if not weeks before the actual holiday, running a holiday-only time-sensitive sale can give your deal just that little extra.

Pro tips

- Lead with the time-sensitive offer. Put the deadline in the subject line as well as front and center in the email copy.

- Be specific about when the deal ends. You don’t want to frustrate customers who thought they could still get it when it has already ended just because your copy was vague.

- Keep into account different time zones when communicating the start and end times for your offer.

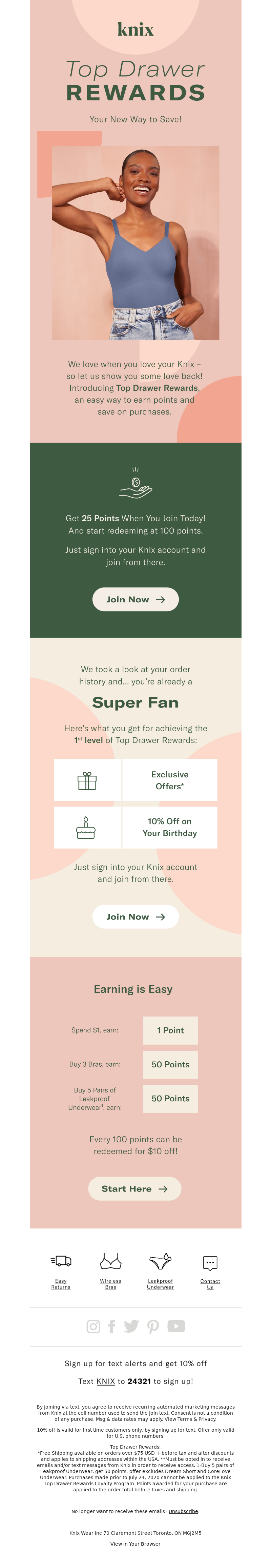

Loyalty program invitation

A great way to create loyal customers is through a customer loyalty program and your email list is a great source of new members.

Why use them

To create repeat customers who feel rewarded for buying from you. Loyalty programs can even make customers come back quicker than they otherwise would have, spurred by the thought that they’ve almost saved enough points for a gift or a discount.

When to send them:

You can send invitations to send your loyalty or reward program all year round, but they’re most effective when they’re less likely to be drowned out by other promotional emails. That means the calmer moments in between holidays and special events are a great time to send them.

Pro tips

- Have a single clear call to action for people to join your program. This should be the focus of your email.

- List the benefits of joining your program./li>

- Show how easy it is to collect points.

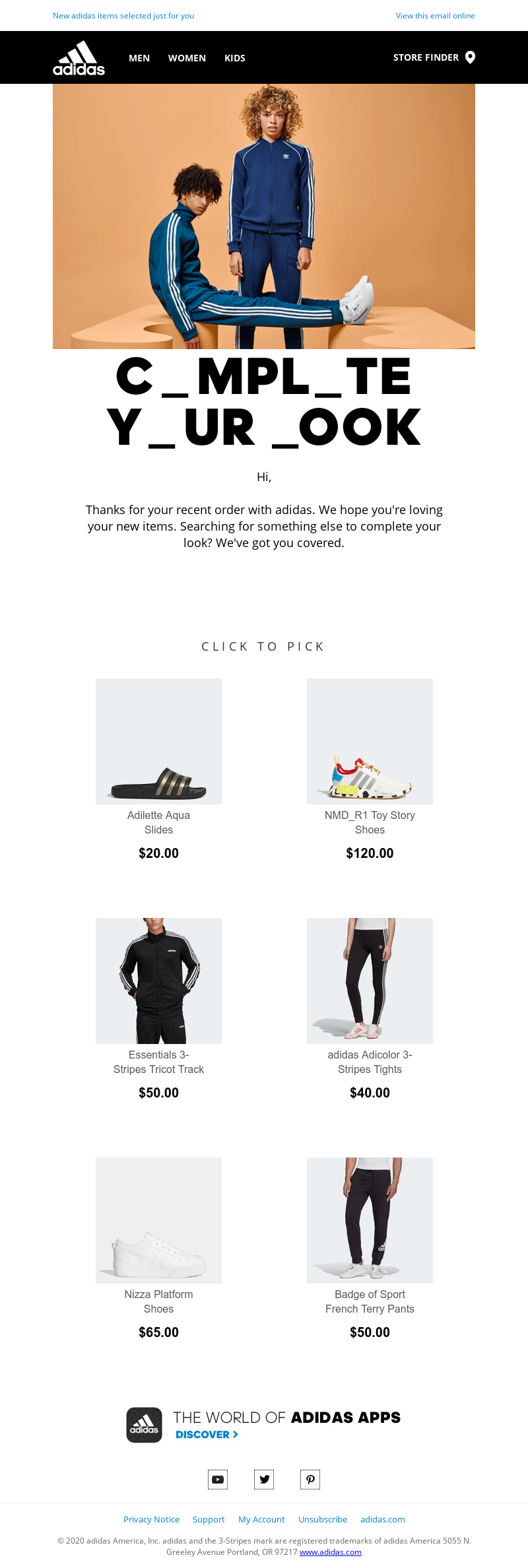

Cross-sells and upsells

Cross-selling and upselling emails build on the excitement of someone who’s just bought from you to offer them a related product, or a better version of what they just bought.

Why use them

People who’ve just bought from you feel excited about your brand, which makes it easier to sell them a little something extra or to convince them to go for the upgraded version of their newest purchase. Adding cross-sells and upsells to your sales process should be a no-brainer.

When to send them:

Cross-selling and upselling emails are post-purchase emails. Include a cross-sell or an upsell offer in your order confirmation email to give people the chance to add to their order. An alternative is to alert customers that you’re about to ship their order and use that email to promote an add-on.

The benefit of promoting a cross-sell or an upsell in your confirmation email is that the recipient will still freshly remember their purchase while including it in a “we’re almost shipping” email creates a sense of urgency as there’s only so much time for the recipient to add something to their order before it gets shipped.

Or you can use both techniques if you think one email won’t be enough to convince a customer to buy something extra or upgrade their purchase.

Pro tips

- Make it easy for the recipient to shop by adding a call-to-action button to your email that instantly adds the cross-sell product to their cart.

- Make the add-on a no-brainer by suggesting a product that’s (much) lower in price than what the customer already bought. For example, socks make a great cross-sell offer when someone’s bought a tracksuit.

- When promoting an upsell, clearly list how the more expensive product is better than what the customer just bought, but be careful to not go so far that the customer won’t be happy about their purchase anymore.

Win-back emails

Win-back or allow you to recuperate otherwise lost sales by re-engaging customers who haven’t bought from you in a while.

They shouldn’t be confused with re-engagement emails which serve to re-engage inactive subscribers (without necessarily inviting them to make a purchase).

Why use them

If someone’s bought from you before, they’re likely to come back to your store and buy from you again. They might just need to be reminded about your offer. On top of that, it’s less expensive to retain an existing customer than it is to acquire a new one.

When to send them:

The timing of your win-back campaign depends on your offer and on how often customers typically buy from you. If you run a subscription box company, for example, you may send a win-back email after someone canceled their subscription, but before their next month would have started, so you can get them right back on track.

If you’re an online retailer of sportswear, however, you might want to wait a little longer.

Pro tips

- Keep your win-back emails fresh and effective by always including the most popular products or the latest news about your brand.

- Add social proof.

- Use segmentation and automation to automatically segment people who haven’t bought from you for a while, but then also remove them from that special list as soon as they’ve made a purchase again so they don’t end up getting an unnecessary win-back email.

Looking for more inspiration for email types? Sign up for MailCharts to view thousands of email examples for the above categories.

Ecommerce Email Marketing Tips

Let’s go over some quick best practices and email marketing tips you should incorporate into your ecommerce email marketing campaigns.

Common questions from ecommerce email marketers include: How frequently should I email? What content should I include? How often should I include a promotion? We’ll briefly cover those questions here.

Email frequency

How often an ecommerce business sends emails depends on its industry and user preferences. A news site sending “breaking news” alerts will email much more frequently than a company like Apple, which seldom releases new products or sales promotions.

With MailCharts, you can look up the send frequency of specific brands as well as for whole industry groups such as apparel, beauty, fitness, home, and tech.

You can use this data to help you plan your own ecommerce email marketing strategy.

Email promotional rate

Once again, email promotional rate depends largely on your brand and positioning. While you don’t want to overdo promotions, training customers to purchase from you only when you offer a sale, promotional emails are also one of the most effective ways to drive online purchases via email.

Create a strategy that balances discounts and incentives with other promotions, and use MailCharts to check how often other brands in your industry are sending promotional emails.

Mobile emails

46% of emails are opened on mobile, so ensure your emails are mobile optimized.

- Use a mobile-first email template. This will make sure that your emails look good in most email clients.

- Go beyond the email. Ensure that your landing and product pages are relevant and mobile optimized too.

Email design and code

What are the best practices when designing your email campaigns? Keep these tips and guidance in mind.

- Keep your emails to 600 pixels wide max.

- Limit your email’s HTML weight to under 102KB of code (excluding images). If you go above this limit, Gmail will truncate your email.

- When creating your email templates, use an email success platform such as Validity Everest to make sure your emails look good on most email clients.

- Compress your images. Nobody wants to have to open heavy images, especially when on a mobile device.

Content

Not sure what to include in your email marketing campaign? Consider these best practices for email content.

- Use images to complement your email’s content, but don’t include just one large image. If a subscriber has images blocked by default, they’ll see an empty-looking email.

- Make sure all images are clickable.

- Diversify your email content between high-value emails and promotions. A good guiding principle is the JJJRH model.

- Add personality to your emails with gifs and emojis.

- Personalize emails based on explicit user preferences and implicit, on-site behavior. Personalized emails work well as they’re more relevant to the recipient

- Send trigger-based emails, depending on the actions (or lack thereof) that users take on your website or app (e.g., abandoned cart email series.)

- Make sure your pre-header text complements your subject line.

- Send your emails from a recognizable “from” name.

- Allow subscribers (and encourage them) to respond to your emails. Don’t use noreply@ email address. If out of office notices are a problem, add an auto-filter for these.

- Use low-friction calls to action that visually stand out. If you can, couple this with an incentive, which will maximize click rate.

Strategy

Let’s talk about email strategy. Create a plan for email frequency, promotions, email types, and more with these quick tips.

- Focus on relevancy over frequency. Imagine that you’re about to receive the email you’re drafting. Would you be excited to receive this? If the answer is no, go back to the drawing board.

- It’s okay to use promotions and discounts, but don’t abuse them; otherwise, subscribers won’t ever purchase at full price.

- Segment your list for added relevancy. If you’re in fashion, male vs. female is a good start. Time zone–specific sending is also another great option.

- Test the heck out of your emails. Content, time of send, sender name, and frequency. Understand what resonates with your audience.

- Review your email drips every 6 months. Your understanding of your subscribers will evolve over time. Incorporate these learnings into each revision.

- If you have an inbound team, sync with them and leverage the great content they’re creating.

- When looking at data, go all the way down your funnel, from email open rate to purchase.

- Send a welcome/confirmation email. Make sure it includes one clear next step the subscriber should take.

Highest-value emails

If you’re looking for high-value, low-hanging fruits, here are the most valuable marketing emails to get started with.

- Shopping cart abandonment

- Browse abandonment

- Replenishment series

- Back-in-stock announcement

- Expiring credit card— especially for subscription-based purchases—give customers a heads-up before their credit cards expire; follow up once a credit card has expired

Now that you’ve learned about types of emails you should create and best practices to follow when sending your campaigns, let’s wrap things up by discussing how to measure success.

Measuring Success: Email Marketing Metrics to Track?

Just like any other marketing activity, the email world has a few unique KPIs that are worth paying attention to and optimizing. Let’s first look at an overview of key email marketing metrics for ecommerce.

The cornerstones of email metrics are open rate and click-through rate (CTR).

An email open rate is the percentage of recipients that opened an email. The click-through rate is the percentage of recipients that clicked on an email.

Now, for someone to click on your email, they first need to open it. Hmm, so we need a way to standardize what we call “click intent.”

This is where the click-to-open rate comes in. This metric helps you understand what percentage of subscribers that opened an email also clicked on a link.

To calculate the click-to-open rate, divide the number of unique clicks in an email by the number of unique opens of the email. Express this number as a percentage.

click-to-open rate = unique clicks / unique opens × 100

A few additional hey things to measure are:

- Unsubscribe rate: the percentage of recipients that unsubscribed from your emails

- Bounce rate: the percentage of recipients who didn’t receive the email (e.g. the send bounced)

- Spam rates: the percentage of recipients that marked your email as spam.

Unsubscribes are one of the most misunderstood metrics in marketing. Embrace them.

To put unsubscribes into perspective: recipients are kindly asking that you no longer email them. This will always be some percentage of the recipients, and oftentimes it will be a trivial sample — 2% would be incredibly high.

What an unsubscribe helps you avoid is a poisoned list: a list full of bounces, or worse – recipients sending your emails to their spam folder. Bounces and spam complaints hurt your deliverability and thus your ability to land in your audience’s inbox. There is no greater fear for an email marketer than getting blocked — even temporarily — by an ISP like Gmail or Outlook.

The net gain of having a clean, engaged list is far greater than losing those addresses who do not want to hear from you. In other words: let subscribers know they can unsubscribe anytime, and make it easy for them to safeguard your list health.

Pro tip: Allow subscribers to manage their communication preferences. Let them choose which emails they receive and how frequently.

Now that you know what to track, let’s talk about how we can improve each metric.

Improving open rate

The easiest way to improve your open rate is to A/B test your subject lines.

Another good subject line complement is the preheader text. The preheader text is the first [n] characters of the email—the value of [n] depends on each email client.

The preheader text will show either next to or below your subject line, again depending on the email client. Your pre-header text should complement your subject line to inspire the recipient to open the email and should be at least 40 characters long.

Another variable you can test is the from name — who the email is coming from. The sender of an email could be [company_name] (e.g., MailCharts), or [first_name] from [company_name] (e.g., Tom from MailCharts), or just about anything you’d like. Set this up in your email service provider when creating your email.

The last variable you can use to improve your open rate is email send time—when is the email being sent. Your open rate will vary based on the day of week and time of day it was sent. You should test this and understand what happens when you email in the evening vs. morning vs. lunchtime. In a recent time-of-day test I did for a client, the difference between the lowest and the highest open rate was a 40% improvement. All emails were sent the same day and had the same exact content.

Also, if your ESP allows it, segment subscribers based on timezone—to standardize a “9 am” send time across the East and West coasts (and the rest of the world).

Improving click rate

When it comes to click rate, everything in the content of your email is up for optimization: calls to action, imagery, copy, links, length of email and the list goes on.

Here are a few general rules that are likely to boost your click rate:

- Make sure all images are clickable

- Use low-commitment CTAs. “Learn more” is often a better option than “Buy now”

- Make sure buttons and links stand out by using bright colors

- Give subscribers an incentive to click through

When analyzing your click rate, remember to normalize based on the open rate—use the click-to-open rate, as mentioned earlier.

Email conversion rate

At best, opens and clicks can inform the success of your email campaigns. And at worst, they can wholly misrepresent your email marketing performance. Let me explain.

An email’s click rate and open rate don’t really matter if the email doesn’t achieve its goal — unless, of course, an open or a click is the goal. Most often, the goal is something else. It’s a conversion. Conversions can take many forms—purchasing a product, leaving a review, or completing a survey.

Here’s where opens and clicks may deceive us. While an email may have a 100% open rate, if nobody buys, then did the email succeed (assuming your goal is to sell)?

Look at the numbers based on the entire funnel. If ecommerce revenue is your goal, you should be able to calculate how much money your last email campaign drove.

If user reactivation is your goal, you should know how many users successfully reactivated thanks to your email.

When analyzing the entire funnel, opens and clicks are just one part of it. Optimizing these top-of-funnel numbers can have a dramatic impact all the way down the funnel. But in isolation, it’s difficult to assess the efficacy of an email campaign by looking simply at opens and clicks.

Improving your conversion rate

While conversion rate optimization (CRO) deserves a whole guide of its own, let’s cover some quick tricks you can use to boost your email conversion rates.

First, make sure you’re linking to the right place. When showcasing a product, your links should drive visitors to the product itself and not to the homepage. Always aim to link as far down the funnel as possible. When pushing for a sale, that means linking to product pages. In the example of a cart abandonment email, drive subscribers directly to their abandoned cart.

Second, automatically apply discounts. If you send an email promoting 20% off, don’t force subscribers to add the promo code manually. All this does is add friction, which reduces your conversion rate.

Third, create some form of urgency. It could be that the promotion expires soon or that only a few items are left. Make subscribers feel that the best time to purchase is now; otherwise, it’ll be too late (without sounding spammy or sleazy!).

Calculating the impact of your campaigns

The best way to measure the impact of your ecommerce email marketing campaigns is to have a holdout group (also called a control group). A holdout group is a set of users, usually between 2% and 5%, that don’t receive specific email campaigns.

By creating a holdout group, you can compare how users that receive emails behave vs. those that don’t. Ideally, the group receiving emails does more of the thing you’re trying to achieve: stay past a free trial, purchase more often with a larger average basket size, refer additional friends to your service, etc.

When determining the impact of your campaigns, the attribution model you use plays a very important role—switching from a last-click attribution to email open paired with a 7-day window can paint a very different picture.

Here’s the spoiler, though: There’s no right or wrong attribution model. You should look at your data gathered through different models and understand what this means for your business.

Also, do your best to place dollar-based metrics around your email marketing efforts. This is a lot easier for ecommerce email campaigns that are driving sales, such as abandoned cart and promotional emails. Many ESPs will track your ecommerce sales attributed to emails to help you better understand the revenue impact of each email, segment, and campaign. For survey emails or review request emails, assigning dollar values to a campaign is more difficult.

However, paired with the holdout group, you’ll be able to point at the numbers and say, “Look, I generated an extra $1 million this year by sending these campaigns.”

Wrapping Up: Additional Ecommerce Email Marketing Resources

Successful ecommerce email marketing takes more than a campaign, an email list, and an ESP. In this guide, we’ve shown why email matters in your digital marketing universe, the different kinds of emails that make up a well-rounded marketing program, and best practices for engaging subscribers and sending effective messages.

As we said in the introduction, we love email and everything it can do to build customer relationships, drive engagement and grow revenue for your company. But even the best ecommerce email marketers can use a hand.

That’s why we created MailCharts: to help ecommerce email marketers succeed. In our database, you can find up-to-date and historical data on how either ecommerce stores and retailers are using email to make product recommendations, promote product releases, create returning customers, and much more.

You can use the insights and inspiration you gather from your competitors’ email marketing campaigns to

- plan and schedule your own campaigns

- build and optimize your emails for better conversion rates

- benchmark your strategy (send frequency, promotional rate, etc.) against industry averages

More specifically, here’s what you’ll get when you sign up:

Valuable data and insights:

- High-level email metrics and data for specific brands and brand groups

- Insights with data about specific industry groups such as Apparel, Beauty, and Fitness

Different search options

- Brand Search so you can see exactly what type of email marketing campaigns your competitors are sending

- Advanced Email Search with options to filter by date, holiday, special characteristic, content and more

Strategy and design

- Outlined Email Journeys with email marketing examples and data on frequency, cadence, promotion rate and more

- Large email displays with an option to switch between desktop and mobile views, HTML code for reverse engineering, and an Inbox View to isolate subject lines

- The option to create your own Custom Lists and Groups so you can save the emails and data that are most relevant to you

- A weekly roll-up email showing all messages sent by targeted groups

Planning and reporting

- Email Exports to save and share with others on your team for review and campaign reporting

- Email Reports with actionable data and email visuals

- Holiday Email Planning targeted to dozens of major holidays and events, with examples, data and strategy.

Ready to get started?

Sign up now and unlock access to thousands of brands and emails along with competitive data, analysis, and ecommerce insights.